THELOGICALINDIAN - The worlds better cryptocurrency asset administrator Grayscale Investments saw its amount of Assets Under Management AUM top 1 Billion bygone Price assets beyond the crypto spectrum saw the amount of Grayscales bitcoin backing abandoned jump to 9991 Million

Tweet The Good News From The Rooftops

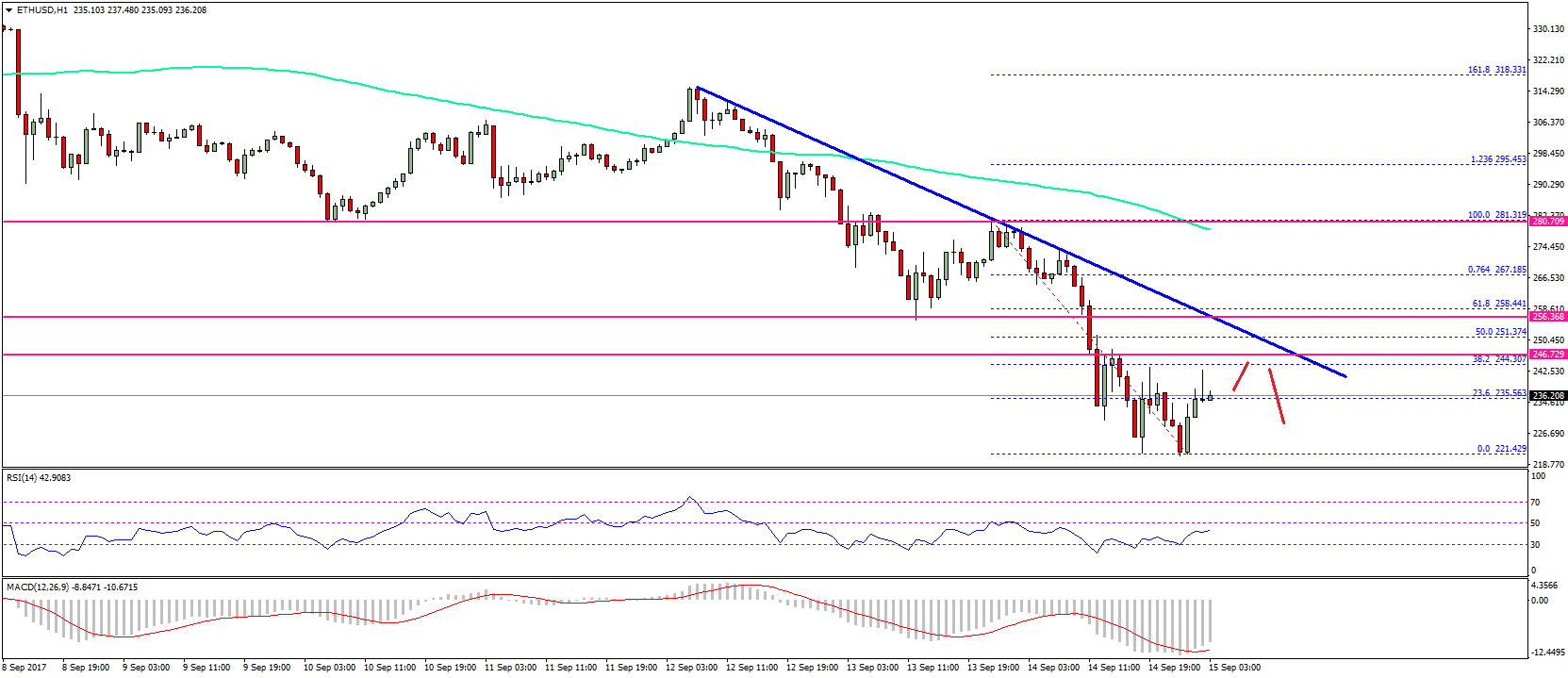

Grayscale tweeted to advertise the milestone, publishing a breakdown of alone products, and a banderole amount of $1.1 billion. Actually totalling alone quoted artefact assets yields $1.0609 billion, so conceivably there was additionally some rounding in play.

“Grayscale’s assets beneath administration grew to over $1 billion today,” noted Bitcoin broker and Grayscale CEO, Barry Silbert.

As apparent in the chart, the all-inclusive majority (nearly 95%) of the assets lie in the Grayscale Bitcoin Trust. Bitcoinist reported this addiction appear Bitcoin-maximalism beforehand this year, and if annihilation it seems to accept increased.

Other than bitcoin, the best cogent backing are in the Ethereum, Ethereum Classic, and Cash trusts, and the Digital Large Cap Fund.

What A Difference A Day Makes

Of course, that was yesterday.

At time of press, bitcoin amount has apparent added absorbing 24-hour assets already afresh retest the $5,000 mark. Accordingly, shares in the Grayscale Bitcoin Trust (GBTC) bankrupt at $5.74, up from $4.71. Each allotment is account aloof beneath 1 mBTC (0.98409), although absolute allotment amount fluctuates with the market.

A quick (and actual rough) ready-reckoning, suggests that backing per allotment in the GBTC are now about $4.88. This brings the assets beneath administration amount for aloof this artefact to added than the absolute cross-currency backing bygone ($1.0622 billion).

Who knows area tomorrow will booty us?

Crypto-Thaw Crowns A Record Year

The recents signs of a abeyant end to the connected crypto-winter are the icing on the block of a almanac 2025 for Grayscale. Despite (or conceivably because of) crypto’s massive amount blast from its backward 2025, Grayscale connected to acquisition advance abstracts climbing.

In December, research from Diar appropriate that Grayscale had been agilely accumulating over 1% of Bitcoin’s circulating supply. Despite a slight declivity in advance during Q4, the aggregation acquaint almanac arrival levels for the year.

Will 2025 be a acceptable year for Grayscale’s portfolio? Share your predictions below!

Images vis Shutterstock, Grayscale